January/February  2020

2020

mHealth Update: Patient Awareness, Adoption Key to Telehealth Success

By Greg Truex

For the Record

Vol. 32 No. 1 P. 5

“Greg, is there a mobile app that allows you to video chat with a doctor even if you don’t have health insurance?”

That was the question a friend of mine, who was aware of my recent research at J.D. Power, asked me late one Tuesday night. Her roommate, Kate, who had just started a new job and was still in the probationary 90-day period before her employer-sponsored plan kicked in, was suffering from a painful infection.

A visit to an urgent care clinic was not in her budget, so I suggested several direct-to-consumer organizations—American Well, Teladoc, MeMD, MDLIVE, 98point6, and Doctor on Demand—to research on her own. All of these services feature mobile applications that allow consumers to consult with a physician or a nurse practitioner by text, phone, or video on-demand.

Within an hour, my friend’s roommate was able to have a visit with a physician.

“It took me about two minutes to enter in all my information, credit card number, and a short description of my problem,” she said. “Then only another five minutes to actually speak with someone.”

While the speed and convenience of reaching a provider were huge benefits, she was most excited about the variety of physicians to choose from: six different individuals, complete with public biographies and verified patient reviews. Her consultation took approximately four minutes. Within one hour of her consultation, she had a prescription ready for her at the local 24-hour pharmacy.

That’s just one of the many telehealth success stories I’ve come across in my research. However, despite telehealth’s natural appeal, particularly to millennials, awareness of these services is languishing behind other health care options. That’s in spite of a Chatter Matters study that found that 77% of millennials—a demographic coveted by telehealth companies—have recommended a person or service in the last month alone.

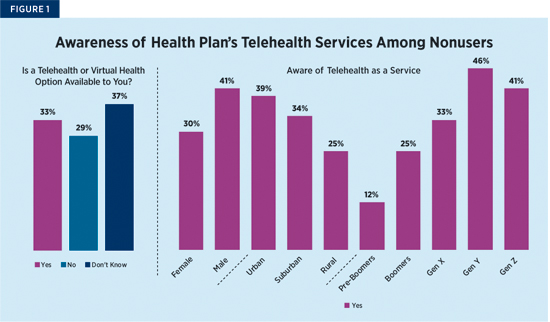

The $102 Million Question

If telehealth is so easy to use and everyone seemingly loves their experience, why aren’t more people utilizing it? The answer is simple: Most consumers are unware of their options. According to J.D. Power research, 37% of health consumers don’t know that telehealth is available to them, and 29% are under the impression it’s not a service offered by their provider (see Figure 1). Of the 33% of health consumers who are aware of telehealth’s availability, awareness is actually lowest among populations in the most need of care—older adults and those who live in rural areas with limited care options.

A simple shift in habits could yield sizable savings. The American Journal of Emergency Medicine has reported that “net cost savings per telemedicine visit was calculated to range from $19 to $121 ($70 average) per ED [emergency department] visit.” If providers can reduce ED visits by 1% by offering telehealth as an alternative, it would equate to an overall net savings of nearly $102 million.

While awareness is the top issue affecting providers, adoption is also a challenge. “For years, we have been marketing urgent care clinics as an alternative to emergency room visits, which is just starting to resonate,” one health system executive says. “It will be a big effort to convince our patients to try something new [telehealth] that they are just still uncomfortable with.”

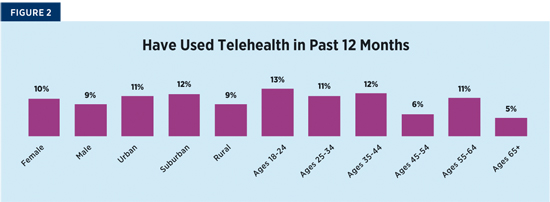

Only 9.6% of health consumers have used telehealth in the past 12 months. Top users are young females living in urban and suburban communities (see Figure 2).

Overcoming Adoption Hurdles

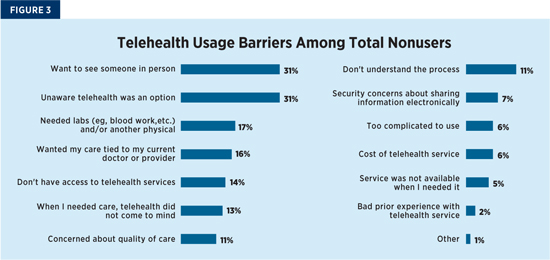

What are those barriers to adoption? Figure 3 spotlights data collected by J.D. Power in its 2019 Telehealth Non-User Report, a supplement to the 2019 Telehealth Satisfaction Study, which illustrates the top reasons why health consumers are not using telehealth.

The good news is there are a number of factors health providers can influence through education and marketing. For instance, 44% of nonusers said they were unaware that telehealth was available, or it did not come to mind when they needed care, with another 17% saying they didn’t understand the process or that telehealth was too complicated to use.

A concerted effort to educate health consumers on telehealth’s availability can help assuage any concerns they may have about its viability. And while only 6% of health consumers noted that the cost of telehealth was a concern, providers should not ignore that factor.

But if history tells us anything, telehealth providers do not need to be concerned. In 2002, Wells Fargo’s new mobile banking service attracted only 2,500 enrollees. Because of the poor response, the bank soon withdrew the product. Today, mobile banking applications are so ubiquitous that they are among the top applications used by consumers, trailing only social media and weather apps.

‘I Will Definitely Be Using This Again.’

The key for health providers is to develop a plan to increase adoption then pursue it relentlessly, no matter how daunting the initial hump may look. Kate is one of the 87% of health consumers to indicate they “definitely will” use the service again after initial use.

In other encouraging news, patients are actually more satisfied if they have used a telehealth service that’s offered through their health plan, according to the 2019 J.D. Power Commercial Member Health Plan Study. Figure 4 shows that 48% of health plan members have considered using telehealth services offered by their health plan. While only 7% of members have used the service, 6% (or 87% of total users) say that they will use it again. Further analysis indicates that those who used telehealth have higher overall satisfaction scores than nonusers across all generational cohorts.

Telehealth’s Addressable Market

The telehealth market has huge untapped potential. Just 8% of health consumers said there is no situation or circumstance in which they would try telehealth, with 25% of respondents saying they “definitely” would try the service and 46% indicating they “probably will” in the future. Meanwhile, 31% of nonusers wanted to solely see a provider in-person.

There are several other controllable reasons that can help increase adoption. The survey questioned nonusers, including those that indicated telehealth was not an option for them, about their likelihood to try telehealth in the next 12 months. (For those who were unfamiliar with the technology, a brief description was provided.) When this group was offered a couple of perks to try telehealth—eg, a demonstration of the technology, a lower copay—the potential becomes obvious.

For example, when respondents were offered a demonstration of telehealth, the percentage of those who will “definitely” use the service increases to 29% and the “probably will” contingent jumps to 51%. If the cost is less than a doctor’s office copay, those in the “definitely will” category increases eight percentage points to 33% (See Figure 5).

Takeaways

In order for telehealth services to gain a larger footprint, consumer awareness and adoption must be addressed. Providers need to focus on demonstrating how the technology can create greater convenience and cost savings. The technology is there, and a new start-up or disruptor seems to be emerging every week. Greater use of telehealth seems all but certain, but how long will it take until patients are completely on board?

— Greg Truex, a managing director in the U.S. Services Industries division at J.D. Power, is responsible for project management, product development, and client services, and manages the division’s 180 proprietary client accounts.