Report Highlights Bullish Outlook by Medical Billing Companies

A nationwide survey conducted by Kareo reveals that medical billing companies expect an average revenue growth of 12% during 2019 as utilization of outsourced billing by independent medical practices continues to increase. Nearly one-third (28%) of physicians and medical practitioners who do not currently outsource medical billing indicated that they plan to do so over the next two years. Kareo's research also uncovered how billing companies are delivering additional value to their medical practice clients through consultative services in the areas of compliance and technology adoption and leverage, as well as practice marketing. Kareo is the leading provider of cloud-based clinical and business management software for independent medical practices and billing companies. The Kareo Medical Billing Industry Report is available for download.

"The challenges of running a successful medical practice in today's dynamic health care landscape continue to impact the time providers have to dedicate to patient care. These practices are turning to their medical billing companies, not only for efficiency and expertise in collecting from insurance payers and patients but also for their insights into overall practice operations, technology adoption, and compliance," says Rob Pickell, chief marketing officer of Kareo. "Our new report highlights the optimism medical billing companies have around their prospects for 2019 and into the future."

The survey highlights that extensive revenue cycle expertise at the specialty level is a successful strategy for building a billing company to scale. Forty-seven percent of small billing companies specialize in order to differentiate themselves, while 58% of medium-sized businesses do. As might be expected, large billing companies tend to diversify across a wider range of medical specialties, responding to the rapid growth (11% since 2012) in multispecialty medical practices.

The significant increase in high deductible insurance plans—the average deductible for employer-based plans reached $1,500 in 2018 and the average deductible for individual Affordable Care Act Bronze plans was more than $5,800 in 2018—is driving the need for billing companies to become specialists in patient collections. Of those surveyed, patient balances account for an average of 23% of total collections. Billing companies that have traditionally charged a lower rate for patient collections now have the opportunity to align their fees with the changing reality of their work models.

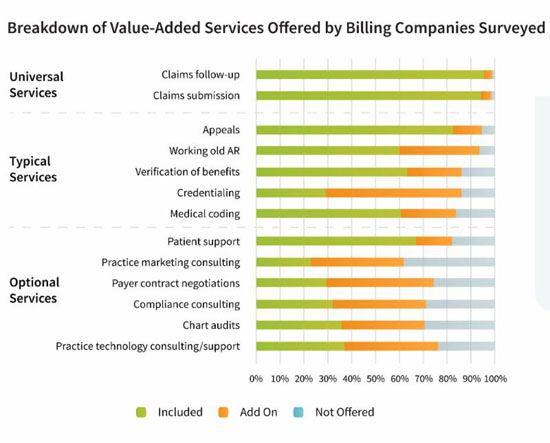

Billing companies are also expanding into new service areas such as technology, regulatory compliance, and patient acquisition to open new revenue paths. Figure 1 shows areas of significant opportunities for growth in value-added services. Helping medical practices implement and leverage technology is something that 75% of billing companies report doing today, with the adoption of integrated EHR and billing software the top area of focus. This focus reflects the recognition by medical practices of the potential for technology to improve practice efficiency and profitability, coupled with the need for guidance and support in avoiding costly technology adoption mistakes. Further, as practices continue to improve their capabilities at non-clinical patient engagement, they see the potential in leveraging billing companies for patient support and communications.

— Source: Kareo